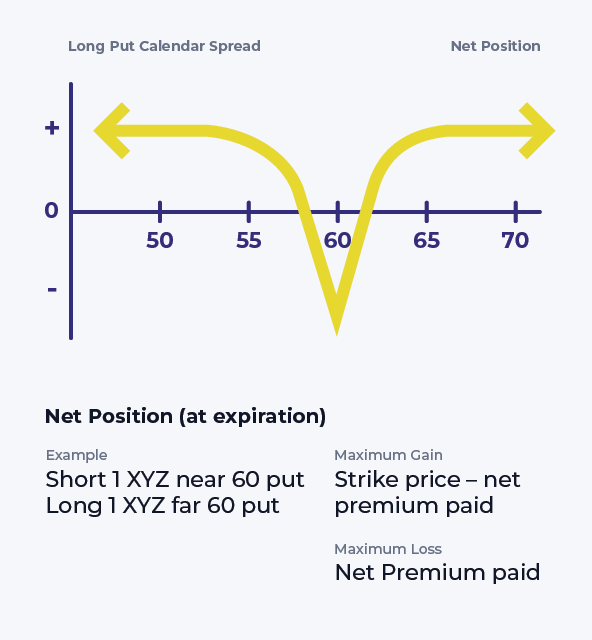

Calendar Put Spread - A calendar spread is an option trade that involves buying and selling an option on the same instrument with the same strikes price, but different expiration periods. A long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put expiring one month later. What is a calendar put spread? What is a calendar spread? A long calendar spread is a good strategy to use when you expect the. Calendar spreads are a great way to combine the advantages of spreads and directional options trades in the same position. A neutral to mildly bearish/bullish strategy using two puts of the same strike, but different expiration dates. What is a put calendar? A calendar spread is an options strategy that involves multiple legs. It is sometimes referred to as a horiztonal spread, whereas a bull put spread or bear call spread would be referred to as a vertical spread.

Calendar Put Spread Options Edge

What is a put calendar? A calendar spread is an option trade that involves buying and selling an option on the same instrument with the same strikes price, but different expiration periods. It is sometimes referred to as a horiztonal spread, whereas a bull put spread or bear call spread would be referred to as a vertical spread. A calendar.

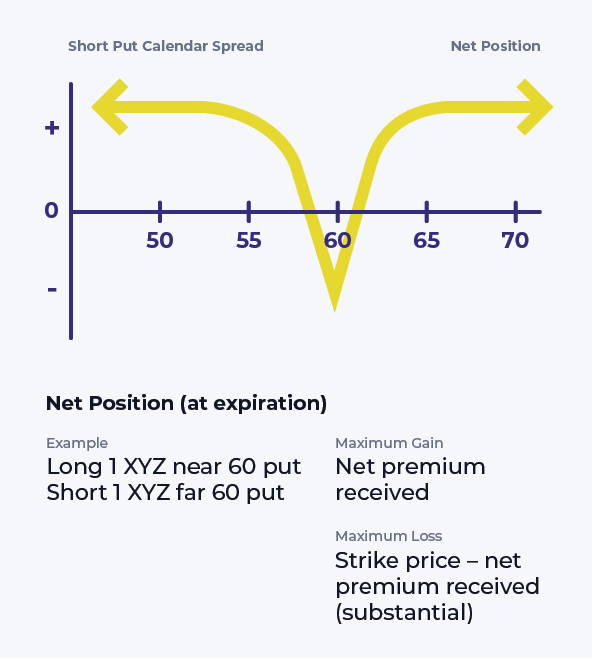

Short Put Calendar Spread Options Strategy

A long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put expiring one month later. It involves buying and selling contracts at the same strike price but expiring on. A long calendar spread is a good strategy to use when you expect the. What is a put calendar? A.

Calendar Put Spread — Options Edge India Dictionary

A calendar spread is an option trade that involves buying and selling an option on the same instrument with the same strikes price, but different expiration periods. It involves buying and selling contracts at the same strike price but expiring on. Calendar spreads are a great way to combine the advantages of spreads and directional options trades in the same.

Calendar Call Spread Option Strategy Heida Kristan

What is a calendar spread? A long calendar spread is a good strategy to use when you expect the. A neutral to mildly bearish/bullish strategy using two puts of the same strike, but different expiration dates. A calendar spread is an option trade that involves buying and selling an option on the same instrument with the same strikes price, but.

Long Calendar Spread with Puts Strategy With Example

A long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put expiring one month later. It is sometimes referred to as a horiztonal spread, whereas a bull put spread or bear call spread would be referred to as a vertical spread. What is a calendar put spread? What is.

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

It involves buying and selling contracts at the same strike price but expiring on. It is sometimes referred to as a horiztonal spread, whereas a bull put spread or bear call spread would be referred to as a vertical spread. What is a calendar put spread? A calendar spread is an option trade that involves buying and selling an option.

Short Put Calendar Spread Printable Calendars AT A GLANCE

What is a calendar put spread? What is a calendar spread? It involves buying and selling contracts at the same strike price but expiring on. What is a put calendar? A long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put expiring one month later.

STZ — Diagonal Calendar Put Spread? for NYSESTZ by OptionsAddicts — TradingView

It is sometimes referred to as a horiztonal spread, whereas a bull put spread or bear call spread would be referred to as a vertical spread. A long calendar spread is a good strategy to use when you expect the. Calendar spreads are a great way to combine the advantages of spreads and directional options trades in the same position..

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

What is a calendar spread? A neutral to mildly bearish/bullish strategy using two puts of the same strike, but different expiration dates. A long calendar spread is a good strategy to use when you expect the. What is a put calendar? A calendar spread is an options strategy that involves multiple legs.

Long Put Calendar Spread (Put Horizontal) Options Strategy

What is a calendar put spread? A calendar spread is an options strategy that involves multiple legs. A neutral to mildly bearish/bullish strategy using two puts of the same strike, but different expiration dates. A long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put expiring one month later..

What is a calendar spread? A long calendar spread is a good strategy to use when you expect the. It is sometimes referred to as a horiztonal spread, whereas a bull put spread or bear call spread would be referred to as a vertical spread. A neutral to mildly bearish/bullish strategy using two puts of the same strike, but different expiration dates. A calendar spread is an option trade that involves buying and selling an option on the same instrument with the same strikes price, but different expiration periods. A long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put expiring one month later. A calendar spread is an options strategy that involves multiple legs. Calendar spreads are a great way to combine the advantages of spreads and directional options trades in the same position. What is a put calendar? What is a calendar put spread? It involves buying and selling contracts at the same strike price but expiring on.

A Calendar Spread Is An Option Trade That Involves Buying And Selling An Option On The Same Instrument With The Same Strikes Price, But Different Expiration Periods.

A long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put expiring one month later. What is a put calendar? What is a calendar put spread? A long calendar spread is a good strategy to use when you expect the.

It Involves Buying And Selling Contracts At The Same Strike Price But Expiring On.

A neutral to mildly bearish/bullish strategy using two puts of the same strike, but different expiration dates. What is a calendar spread? Calendar spreads are a great way to combine the advantages of spreads and directional options trades in the same position. It is sometimes referred to as a horiztonal spread, whereas a bull put spread or bear call spread would be referred to as a vertical spread.

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://i2.wp.com/assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/607da29411b814023198cd31_Put-Calendar-Spread-Options-Strategies-Option-Alpha-Handbook.png)

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://i2.wp.com/assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019b83133ac2d32ef084fa5_TsbQgZxQ0e-zKJ9h6Fa7azNlnvn0zH-UBlX3l7hriHll2es1fvyFY5N-nOyM1153MJ4wXLNIhH4zanFkJQB0mpqs81lwEBIvqa7IZQRPWXZY1i3J7vV3BpTIL3v5nCyqn-CEbq2U.png)